A Beginner's Guide To Crypto Technical Analysis

Aug 8, 2024

Trey Munson

Crypto Signals

Unlocking the basics of crypto technical analysis can significantly enhance your trading skills. Mastering crypto technical analysis is critical to navigating the market with confidence. Whether you are a seasoned trader or just beginning, understanding crypto signals can significantly improve your trading outcomes.

At Digital Dollars Trading, our options trading room is designed to help you deepen your market understanding. This platform guides you through options trading, helping you achieve your trading goals. Visit our options trading room to explore how Digital Dollars Trading can boost your trading journey.

Table of Contents

What Is Crypto Trading?

Crypto trading involves taking a financial position on the price movement of individual digital assets against the dollar or other digital assets. This trading is done through crypto/dollar pairs or crypto to crypto pairs. Contracts for Difference (CFDs) are famous for crypto trading as they offer flexibility, leverage, and the ability to take long and short positions.

Since the debut of Bitcoin in 2009, crypto trading has gained popularity. While there were only 66 types of digital assets in 2013, there are currently over 10,000 different digital assets available in the market. Digital assets are digital coins created using blockchain or peer-to-peer technology with cryptography. They differ from fiat currencies issued by governments because they are intangible, made up of bits and bytes, and do not have a central authority like a central bank regulating their circulation.

Digital assets are not legal tender as they are not issued or controlled by any government. Despite not being recognized as legal tender worldwide, digital assets have the potential to change the financial landscape and present new investment opportunities for traders to capitalize on. The blockchain technology underlying crypto creation has opened up new frontiers for investors to explore.

Related Reading

• Day Trade Crypto

• How To Trade Cryptocurrency

• Crypto Signals

• Crypto Trading Strategies

• Crypto Trading Signals

• How To Trade Cryptocurrency And Make Profit

• Cryptocurrency Courses

• Crypto Telegram Groups

• Crypto Community

• Crypto Tips

What Is Crypto Technical Analysis?

Technical analysis is the ultimate tool in crypto, separating successful trading from mere guesswork. By studying market trends, patterns, and price movements, traders can predict entry points, price variations, sell signals, market trends, and many other potential future outcomes. This analysis is critical in becoming a profitable crypto asset trader.

Unlike fundamental analysis, which focuses on a crypto token's utility and market perception in the long run, technical analysis relies solely on price patterns and volume data displayed on a crypto chart. This method is beneficial for traders who want to make informed decisions based on historical patterns and price movements.

Unlock financial freedom through expert options and crypto trading guidance with Digital Dollars Trading.

At Digital Dollars Trading, we provide a premier community, mentorship program, and proven strategies to help you master profitable trading. We've helped our students to make upwards of $30,000+ in a single day through our 1-1 mentorship, Exclusive Workshops & VIP Events, Daily trading signals, live calls, and expert tips from Trey. Escape the rat race with Trey and the rest of the Digital Dollars Trading community today. Try it out today!

How Does Crypto Technical Analysis Work

Applying technical analysis to crypto trading involves scrutinizing market data to predict future price movements and make informed trading choices. This approach isn't new and has been applied in various financial markets, but it is tailored to the crypto realm. The core idea is to identify patterns and signals in historical trading data to predict future price behavior.

In the practical application of technical analysis, traders use different tools to assess market conditions. One such tool is the candlestick chart, offering a detailed view of price movements within specified time frames. These charts are precious, showcasing price ranges and reflecting market sentiment with their color-coded bodies and wicks. Traders can also draw on trendlines to mark support and resistance levels, pivotal in identifying potential barriers to price action due to concentrated buying or selling activity. These trendlines are vital in shaping trading strategies by suggesting when to buy near support levels or sell near resistance levels under the existing trend.

Furthermore, moving averages are central to technical analysis. They present a streamlined view of price trends by averaging price data over a specific period. These indicators are convenient in identifying support and resistance in uptrends and downtrends. For instance, a 200-day moving average can act as a support level during an uptrend, pointing to a potential entry point for buyers.

Charts for Crypto Technical Analysis

1. Line Charts

Line charts are fundamental in technical analysis. They use a single data point: the closing price. A line is formed by plotting a series of closing prices on a chart to help identify trends. These charts provide a basic view of the price action, with the closing prices as the central focus.

2. Bar Charts (Open High Low Close Chart)

Bar charts offer more details than line charts, incorporating the open, high, low, and close of each bar plotted on the chart. Commonly known as OHLC charts, these charts comprehensively illustrate price movements for technical analysis.

3. Candlestick Charts

Originating in Japan in the 1700s, rice merchants first used candlestick charts, which Steven Nison later introduced to the West. These charts utilize the open, high, low, and close prices more visually, making them popular among traders. The depiction of candlestick charts is rich in information, making it easier to interpret market trends.

Candlestick charts are viral among crypto traders. They offer insights into market patterns to predict potential future outcomes. Each candle represents a different time interval, showcasing the opening, closing, highest, and lowest prices. By understanding the characteristics of each candlestick, traders can make informed decisions based on market trends.

Unlock financial freedom through expert options and crypto trading guidance with Digital Dollars Trading. We provide a premier community, mentorship program, and proven strategies to help you master profitable trading. Join our options trading room today to start your journey towards financial success.

How To Read Crypto Charts

Crypto traders often rely on the patterns and indicators found in charts to make informed decisions. Understanding these charts can help you identify trends and predict potential price movements. Here is a breakdown of the key elements you'll encounter when reading crypto charts.

Key Elements of a Crypto Chart

Trading Pair

This indicates which base currency (e.g., BTC) and quote currency (e.g., USDT) are traded in a specific market.

Current Price

This reflects the prevailing price for the base currency (BTC) in exchange for the quote currency (USDT). It also includes indicators showing price changes over the past 24 hours.

High/Low

These values show an asset's highest and lowest prices within a 24-hour period.

24H Vol

This indicates the volume of a particular asset (e.g., BTC) traded over the past 24 hours, expressed in the quote currency (USDT).

Unit of Time

Users can select time increments ranging from one minute to one month to analyze the market.

Price Chart

This visualizes the price movement of crypto over time, typically using candlesticks to represent price activity within a specific time unit.

Trading Volume

This chart displays trading volume, with green bars indicating price increases and red bars showing price decreases.

Candlestick Patterns

Candlestick patterns, which are categorized as bullish or bearish, provide insights into potential future price movements. A bullish pattern indicates a likely price increase, while a bearish pattern suggests a possible price decrease.

Shooting Star Candlestick

A bearish pattern signals resistance to further price increases.

Inverted Hammer Candlestick

A bullish pattern suggests a potential price rebound.

Head and Shoulders

It is recognized by three peaks or valleys, indicating potential price swings.

Wedges

Patterns that show stabilization or potential price peaks.

By analyzing these chart elements and patterns, traders can make informed decisions about buying or selling crypto assets. Understanding the complexities of crypto charts is vital for navigating the volatile landscape of digital asset trading.

Related Reading

• Short Term Crypto Trading

• Crypto Financial Advisor

• Top Crypto Influencers

• Best Crypto Trading Bot For Beginners

• Cryptocurrency Risks

• Bitcoin Trading Strategies

• Cryptocurrency Analysis

• Crypto Portfolio Allocation

• Day Trading Cryptocurrency

• Crypto Analysis Tools

• Best Crypto Discord

What Is The Best Crypto Technical Analysis Site?

1. Digital Dollars Trading

Are you looking to unlock financial freedom through expert options and crypto trading guidance? With Digital Dollars Trading, you can join a premier community and mentorship program, gaining access to proven strategies to help you master profitable trading. Students have made upwards of $30,000+ in a single day through our 1-1 mentorship, Exclusive Workshops & VIP Events, Daily trading signals, live calls, and expert tips from Trey Munson.

Join Trey and the rest of the Digital Dollars Trading community to escape the rat race and embark on your journey to financial independence today!

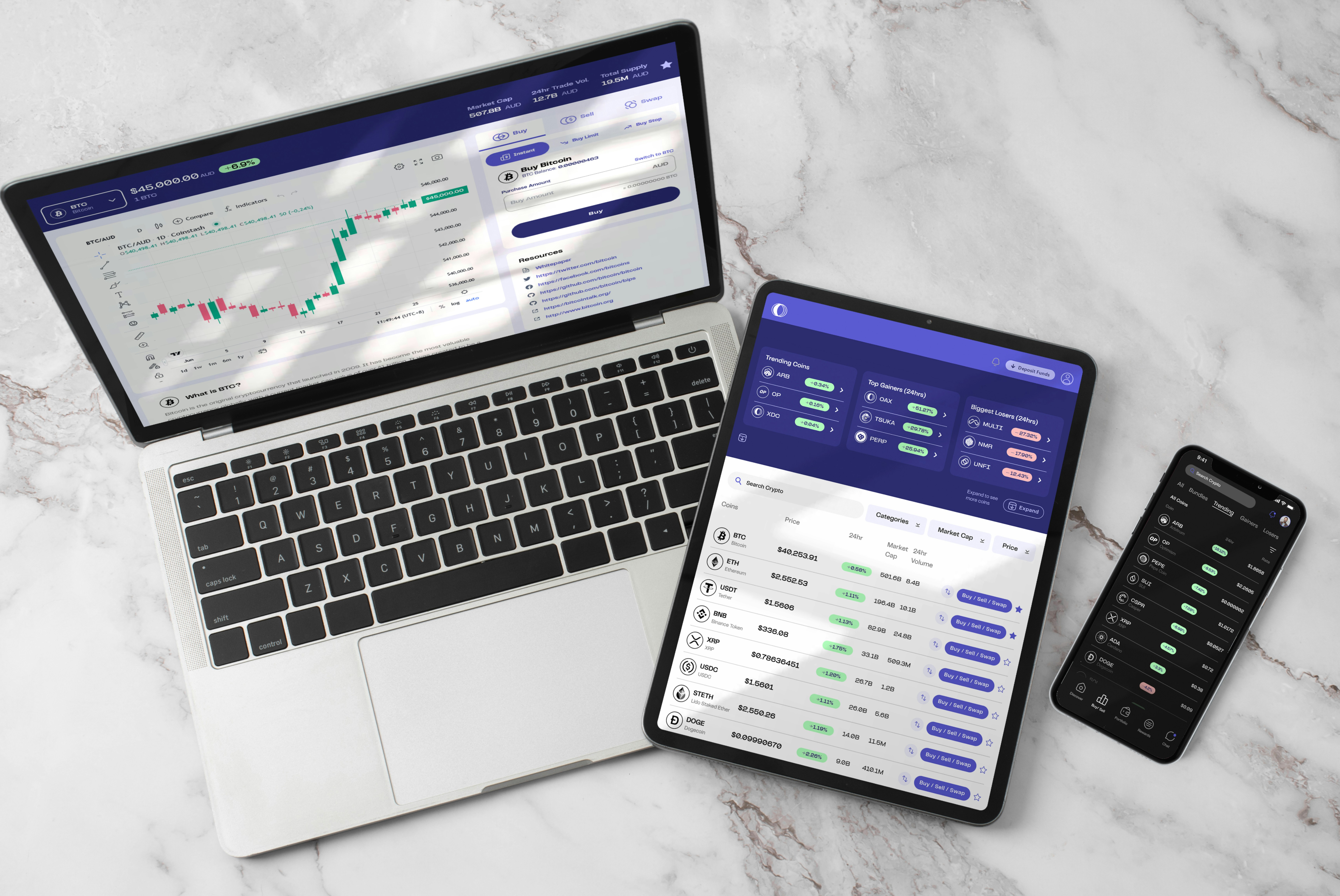

2. TradingView

TradingView provides various tools and features to analyze markets and track price movements. The platform offers real-time data on various markets, all customizable and savable for later use. TradingView's standout feature is its community, where users can share ideas, educate each other, create custom trading indicators, and watch live streams from professional traders and investors.

3. Coinigy

Coinigy is a specialized crypto charting tool that offers valuable insights and analytics into the crypto market from over 45 exchanges. With an intuitive interface, Coinigy is suitable for new investors' charting tools. The platform ensures safety and security for crypto assets, following best security practices with encrypted user data, secure SSL requests, 2FA support, and timestamped logins.

4. CryptoWat.ch

CryptoWat.ch is a crypto-tracking platform that allows users to monitor prices and trends across various digital assets on multiple exchanges. With real-time market data, customizable watchlists, and advanced charting tools, CryptoWat.ch is valuable for active traders and investors. The platform offers generous pricing plans with core features that are entirely free of use, along with robust security features such as multi-factor authentication and ownership by Kraken, which is known for protecting users' assets.

5. GoCharting

GoCharting is a powerful multi-asset charting tool for traders and investors, offering insights into multiple markets, including crypto. With a focus on US and Indian markets, GoCharting provides premium features for users trading in traditional markets. The platform includes an academy to help beginners learn how to utilize the platform effectively. Experienced investors will enjoy the Options Desk, a powerful tool for building, trialing, and executing strategies.

6. CryptoView

CryptoView is a comprehensive crypto charting and trading tool that allows users to strategize and exchange all from one platform. Utilizing charts and tools from TradingView, CryptoView offers more than 85 technical indicators and 75 drawing tools. Other features include multi-screens, news aggregator, events calendar, shareable portfolios, and alerts via email, SMS, or in-browser. With enterprise-grade security features, CryptoView ensures cloud architecture, SSL encryption, API key encryption, and DoS protection.

Learn How To Trade Profitably in The Digital Dollars Trading Discord

Are you looking to enhance your trading skills and profit from the volatile crypto market? At Digital Dollars Trading, we offer a range of resources and tools to help you achieve financial independence through expert options and crypto trading. Our comprehensive mentorship program, exclusive workshops, and proven strategies are designed to help you master profitable trading and unlock your full potential in crypto.

Join a Premier Community of Traders

When you join Digital Dollars Trading, you become part of a premier community of traders passionate about the crypto world. Our community comprises like-minded individuals committed to helping each other succeed through shared knowledge, experiences, and insights. With our support, you can connect with other traders, share ideas, and learn from one another to improve your trading skills and maximize your profits.

Get Expert Mentorship from Trey Munson

One of the key benefits of joining Digital Dollars Trading is the opportunity to receive expert mentorship from Trey Munson. Trey is a seasoned trader with years of experience in the crypto market, and he has helped countless students achieve their financial goals through his expert guidance and advice. With Trey's mentorship, you can learn how to make informed trading decisions, spot profitable opportunities, and confidently navigate the complexities of the crypto market.

Access Proven Strategies and Daily Trading Signals

At Digital Dollars Trading, we provide our members access to proven trading strategies and daily trading signals to help them quickly make profitable trades. Our strategies help you identify high-probability trading opportunities, manage risk effectively, and maximize your profits in any market conditions. Our daily trading signals also provide real-time alerts on potential trading opportunities so you never miss out on a profitable trade again.

Experience Exclusive Workshops and VIP Events

As a member of Digital Dollars Trading, you can attend exclusive workshops and VIP events to enhance your trading skills and knowledge further. These events are led by industry experts and thought leaders who share their insights, strategies, and tips to help you succeed in the crypto market. By attending these events, you can network with other traders, expand your knowledge, and stay ahead of the curve in the ever-evolving world of crypto trading.

Become a Part of the Digital Dollars Trading Community Today

If you're ready to escape the rat race and achieve financial freedom through expert options and crypto trading, then Digital Dollars Trading is the place for you. Join our community today and start your journey towards financial independence with the help of Trey Munson and the rest of the Digital Dollars Trading team. Try out our mentorship program, exclusive workshops, daily trading signals, live calls, and expert tips to take your trading skills to the next level. Take advantage of this opportunity to unlock your full potential and achieve your financial goals with Digital Dollars Trading.

Related Reading

• How To Day Trade Cryptocurrency

• Best Crypto Courses

• Technical Analysis Crypto

• Crypto Indicator

• How To Analyze Cryptocurrency

• Crypto Risk Management

• Top Crypto Traders

• Crypto Resources

Terms of Service