A Step-by-Step Guide on How to Analyze Crypto

Sep 28, 2024

Trey Munson

Crypto Signals

Analyzing crypto is crucial for making informed investment decisions. By understanding crypto signals and studying price charts, you can better predict whether a crypto is worth buying or is best to wait. This guide will show you how to analyze crypto step by step.

At Digital Dollars Trading, our options trading strategy room offers a hands-on environment where you can practice crypto analysis and build confidence before trading independently.

Table of Contents

How Digital Dollar Trading Can Help You Analyze Crypto Effectively

Learn How To Trade Profitably in The Digital Dollars Trading Discord

Why Crypto Analysis is Essential

Crypto analysis is critical for anyone looking to invest, trade, or understand the rapidly evolving digital asset landscape. With thousands of digital assets available, each with unique features and purposes, a thorough analysis can help investors make informed decisions. Below, we explore the various types of digital assets and the need for a comprehensive analysis.

Understanding the Types of Digital Assets

Digital assets can be categorized into several types, each serving distinct functions within the broader ecosystem. Here are the main categories:

Payment Digital assets

Examples

Bitcoin (BTC), Litecoin (LTC), Bitcoin Cash (BCH)

Description

These digital assets are designed primarily as a medium of exchange. Bitcoin, the first crypto, exemplifies this category by facilitating peer-to-peer transactions without intermediaries. Payment digital assets aim to provide a decentralized alternative to traditional currencies, enabling faster and cheaper transactions globally.

Utility Tokens

Examples

Ethereum (ETH), Binance Coin (BNB)

Description

Utility tokens serve specific functions within their respective platforms. For instance, Ethereum's Ether powers intelligent contracts and decentralized applications (dApps) on its blockchain. Utility tokens often provide users access to services or products within an ecosystem and can be essential for participating in specific projects.

Stablecoins

Examples

Tether (USDT), USD Coin (USDC)

Description

Stablecoins are pegged to traditional fiat currencies, such as the U.S. dollar, to minimize price volatility. They combine the benefits of crypto—such as fast transactions and low fees—with the stability of fiat currencies, making them ideal for trading and storing value during market fluctuations.

DeFi Tokens

Examples

Uniswap (UNI), Aave (AAVE)

Description

Decentralized Finance (DeFi) tokens enable financial services without traditional intermediaries such as banks. They allow users to borrow and earn interest on their crypto holdings through smart contracts on blockchain platforms.

Security Tokens

Examples

tZERO, Polymath

Description

Security tokens represent ownership in an asset or company and are subject to federal regulations. They provide investors with rights similar to traditional securities, such as dividends or profit-sharing.

Non-Fungible Tokens (NFTs)

Examples

CryptoPunks, Bored Ape Yacht Club

Description

NFTs represent unique digital assets verified on a blockchain. Unlike digital assets, which are interchangeable, each NFT has distinct properties that make it one-of-a-kind. They are often used for digital art and collectibles.

Importance of Crypto Analysis

Conducting a thorough crypto analysis is essential for several reasons:

Informed Investment Decisions

Understanding the different types of digital assets allows investors to identify which assets align with their investment goals and risk tolerance. Analyzing factors such as market capitalization, technology, use cases, and community support can help investors select promising projects with long-term potential.

Risk Management

The crypto market is volatile; therefore, analyzing market trends and historical performance can help investors manage risks effectively. By understanding price movements and market sentiment, investors can make strategic decisions about when to enter or exit positions.

Identifying Opportunities

In a rapidly changing market with thousands of options, analysis helps uncover hidden gems—lesser-known digital assets that may offer significant upside potential compared to established coins like Bitcoin or Ethereum.

Understanding Market Dynamics

Analyzing crypto involves examining broader market trends, regulatory developments, and technological advancements. Staying informed about these factors enables investors to anticipate market shifts and adapt their strategies accordingly.

Evaluating Project Viability

Fundamental analysis allows investors to assess the viability of a crypto project based on its team, technology, tokenomics, and community engagement. This evaluation helps distinguish between legitimate projects and those that may be scams or lack substance.

Enhancing Trading Strategies

For traders, technical analysis is crucial in identifying entry and exit points based on price charts and indicators. By analyzing historical data patterns and trends, traders can develop strategies that maximize their chances of success in short-term trading.

Related Reading

• How To Trade Cryptocurrency

• Crypto Trading Strategies

• Crypto Trading Signals

• How To Trade Cryptocurrency And Make Profit

• Cryptocurrency Courses

• Day Trade Crypto

• Crypto Telegram Groups

• Crypto Community

• Crypto Tips

Step 1: Understanding Fundamental Analysis (FA)

What is Fundamental Analysis?

Fundamental Analysis (FA) evaluates a crypto’s long-term value by examining its underlying technology, the team behind the project, partnerships, and overall market potential. Unlike technical analysis, which focuses on price movements, FA seeks to assess the project's overall viability and utility.

Why It’s Important

Long-Term Perspective

FA is crucial for identifying digital assets with strong growth potential over time. It helps traders and investors distinguish between solid projects with genuine use cases and those that may be driven by hype or speculation.

Reduce Risk

By thoroughly understanding a project’s fundamentals, traders can reduce the risk of investing in unreliable or unsustainable projects.

Steps to Perform Fundamental Analysis (FA)

Step 1: Evaluate the Whitepaper

The whitepaper is the foundational document of any crypto project. It outlines the problem the project aims to solve, the technology it uses, and the project’s goals.

Key Points to Look For

Clarity and Detail: A good whitepaper should clearly explain the project’s goals and how it plans to achieve them.

Problem-Solving: Does the project address a real problem in the industry? Is the solution innovative or simply a copy of an existing project?

Realistic Roadmap: Does the project have a practical and achievable timeline for its goals, or does it promise unrealistic outcomes?

Pro Tip

Avoid projects with vague or overly complicated whitepapers. Transparency is key to evaluating whether the project can deliver on its promises.

Step 2: Assess the Team Behind the Project

A crypto project is only as strong as the people leading it. Research the team to assess their experience, background, and track record in the blockchain or tech industries.

Key Points to Look For

Experience: The team should have relevant experience in blockchain technology, software development, or finance.

Transparency: Check if team members are public figures with verifiable LinkedIn profiles or previous successful ventures.

Advisory Board: A robust advisory board with industry veterans can signal confidence in the project’s long-term success.

Pro Tip

Be cautious if the team is anonymous or lacks verifiable credentials, as this could be a red flag for potential scams or unreliable projects.

Step 3: Examine the Technology

Understanding the underlying technology is crucial for assessing the feasibility and innovation behind a crypto project.

Key Points to Look For

Blockchain Consensus Mechanism: Is the project using Proof of Work (PoW), Proof of Stake (PoS), or another consensus mechanism? Each has its pros and cons regarding scalability, security, and energy consumption.

Scalability: Can the blockchain handle high transaction volumes? Projects that solve scalability issues are more valuable in the long term.

Unique Selling Point (USP): What differentiates this project from others? Does it offer unique features like faster transaction times, better security, or lower fees?

Pro Tip

Look for projects with working products or prototypes, showing the team can execute their vision.

Step 4: Analyze Partnerships and Collaborations

Strong partnerships with established companies or blockchain platforms can significantly boost a crypto’s chances of success.

Key Points to Look For

Industry Partnerships: Collaborations with recognized companies or blockchain platforms can validate and provide resources to the project.

Exchange Listings: Being listed on reputable exchanges indicates trustworthiness and increases liquidity.

Community and Developer Support: Does the project have an active community of users and developers contributing to its growth? This signals long-term sustainability.

Pro Tip

Projects with reputable partnerships are more likely to succeed because they can leverage additional resources, credibility, and expertise.

Step 5: Community and Adoption

The size and engagement of the project’s community can indicate the level of interest and support for the crypto.

Key Points to Look For

Active Community: Platforms like Reddit, Twitter, and Telegram can give you insight into the project’s community engagement. Active discussions and community support are positive signs.

Adoption Rate: A growing number of users or businesses adopting the crypto suggests real-world use cases and long-term value.

Pro Tip

Monitor community sentiment, but be cautious of hype. A robust and engaged community should focus on the project’s progress and technological value, not just price speculation.

Step 2: Technical Analysis (TA)

Grasping the Basics of Technical Analysis for Crypto Signals

Technical analysis is a method for evaluating assets by analyzing statistics generated by market activity, such as past prices and trading volume. The goal is to identify patterns that can suggest future activity. By studying price charts and using various indicators, traders aim to make informed decisions about when to buy, sell, or hold an asset.

Study Price Charts

The foundation of technical analysis is studying price charts. These charts visually represent the price movement of an asset over time. Candlestick charts are popular as they clearly show the open, high, low, and close prices for each time (e.g., hourly, daily, weekly). When analyzing charts, looking at multiple time frames is crucial to understanding the market comprehensively.

Short-term traders may focus on hourly or daily charts, while long-term investors may examine weekly or monthly charts. Platforms like TradingView allow you to easily switch between different time frames and view detailed price charts.

Identify Key Indicators

Technical indicators are mathematical calculations based on price and volume data. They help identify trends, momentum, and potential reversals. Some of the most commonly used indicators include:

Moving Averages (MA)

These smooth out price data to create a trend-following indicator. Simple moving averages (SMA) and exponential (EMA) are popular. Moving averages can help identify the trend direction and potential support/resistance levels.

Relative Strength Index (RSI)

The RSI is an oscillator that measures the momentum of an asset's price movement. It ranges from 0 to 100, with readings above 70 suggesting overbought conditions and below 30 indicating oversold conditions. The RSI can be used to identify potential reversals.

Bollinger Bands

Bollinger Bands consist of a middle band (a simple moving average) and two standard deviation bands placed above and below the middle band. They help identify volatility by showing when prices are high or low relative to one another.

Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of an asset's price. It can identify trend direction, momentum, and potential signals. When using indicators, it's essential to understand their underlying calculations and how to interpret their signals. For example, if the RSI is above 70, the asset may be overbought and due for a pullback. If the MACD line crosses above the signal line, it could be a buy signal.

Support and Resistance Levels

Support and resistance levels are price points where an asset's price tends to stop and reverse. Support levels act as price floors, while resistance levels act as price ceilings. These levels can be identified by plotting historical highs and lows on the chart. When an asset's price approaches a support level, it may bounce back up.

If it breaks below support, it could continue moving lower. Similarly, if an asset's price approaches a resistance level, it may reverse and move lower. If it breaks above resistance, it could continue moving higher.

Use Trend Lines

Trend lines are a simple yet powerful tool in technical analysis. They are drawn by connecting at least two price points (usually lows for an uptrend and highs for a downtrend). Trend lines help identify the market's overall direction and can be used to spot potential support/resistance levels. An uptrend line connects at least two rising lows, while a downtrend line connects at least two declining highs. If the price breaks below an uptrend line or above a downtrend line, it could signal a potential trend reversal.

By combining chart analysis, technical indicators, support/resistance levels, and trend lines, traders can comprehensively understand an asset's price behavior and make more informed trading decisions. However, it's critical to remember that technical analysis is not a crystal ball and should be used with other analysis methods and risk management strategies.

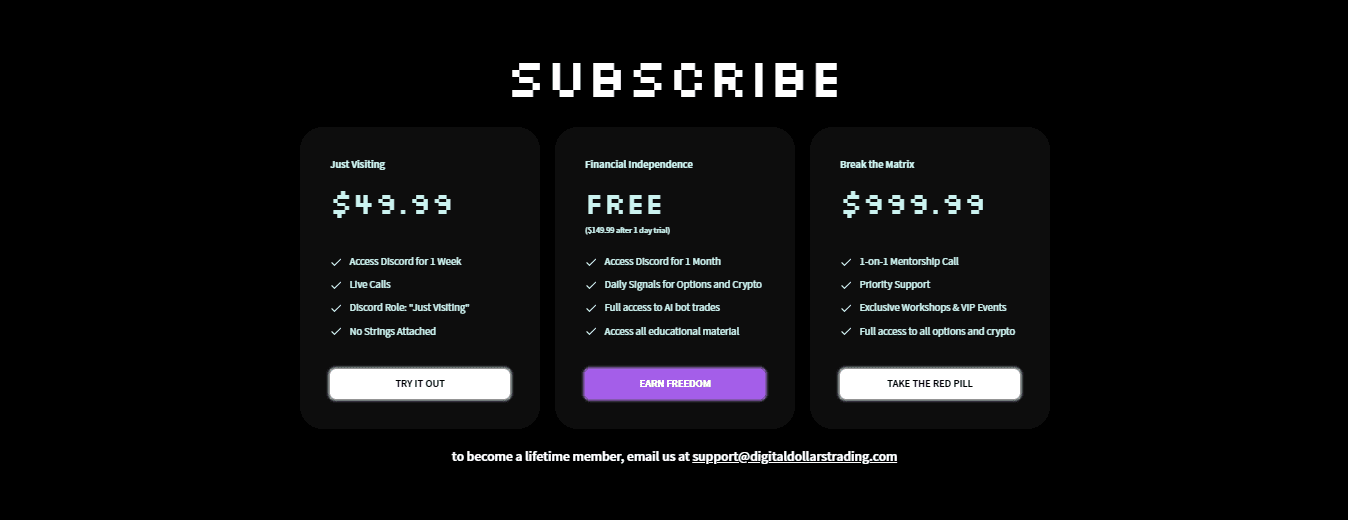

Unlocking Financial Freedom Through Expert Options and Crypto Trading Guidance

Unlock financial freedom through expert options and crypto trading guidance with Digital Dollars Trading. We provide a premier community, mentorship program, and proven strategies to help you master profitable trading. We've helped our students to make upwards of $30,000+ in a single day through our 1-1 mentorship, Exclusive Workshops & VIP Events, Daily trading signals, live calls, and expert tips from Trey. Escape the rat race with Trey and the rest of the Digital Dollars Trading community today. Try it out today!

Step 3 - Sentiment Analysis

Tap into Social Media Channels

Social media platforms are crucial for determining public interest and sentiment around digital assets. Here’s how to effectively monitor these channels:

Identify Key Platforms

Focus on platforms like Twitter, Reddit, and Telegram, where crypto traders and enthusiasts actively discuss market trends.

Engage with the Community

Follow influential figures in the crypto space, join relevant groups, and participate in discussions to gain insights into current sentiments.

Analyze Conversations

Look for recurring themes or sentiments in discussions. Are users excited about a new project, or are there concerns about regulatory issues? This qualitative analysis can provide valuable context.

Pro Tip

Be cautious of hype. Differentiate between genuine enthusiasm and speculative bubbles. Not all positive sentiment translates to sustainable price increases, so it's essential to assess the underlying factors driving the sentiment.

Track News and Announcements

News coverage and official announcements can significantly impact crypto prices. Here’s how to stay informed:

Follow Crypto News Outlets

Check reputable sources like CoinDesk, CoinTelegraph, and CryptoSlate for breaking news and in-depth articles on market developments.

Set Up Alerts

Use Google Alerts or similar tools to receive notifications about specific digital assets or relevant news. This ensures you’re continually updated on significant developments.

Monitor Major Announcements

Pay attention to announcements from developers or teams behind projects, such as partnership updates, technological advancements, or regulatory changes. These can have immediate effects on market sentiment.

Use Sentiment Tools

Various tools are available to help automate sentiment analysis and provide deeper insights:

LunarCrush

This platform aggregates social media mentions and provides metrics on overall sentiment for various digital assets. It analyzes data from Twitter, Reddit, and other platforms to view market mood comprehensively.

TheTie

This tool offers sentiment analysis based on social media data, providing insights into traders' feelings about digital assets. It also tracks price movements with sentiment changes.

Fear & Greed Index

This index measures market sentiment by analyzing volatility, momentum, social media activity, and trading volume. A high greed score may indicate a potential market correction, while fear can signal buying opportunities.

Combine Multiple Data Sources

For a well-rounded analysis, integrate data from various sources:

On-Chain Analysis

Use tools like Glassnode or Santiment that provide insights into blockchain activity (e.g., transaction volumes, wallet movements) alongside social media sentiment. This helps contextualize public opinion with actual market behavior.

Community Engagement Metrics

Analyze community engagement through metrics such as the number of active forum users or participation rates in community events (like AMAs). High engagement often correlates with a positive sentiment like Digital Dollars Trading.

Visualize Sentiment Data

Utilize data visualization tools to make sense of complex sentiment data:

Create charts that display sentiment trends over time alongside price movements.

This can help identify correlations between public opinion shifts and price changes.

Use dashboards that aggregate multiple metrics (social media mentions, news articles, on-chain data) for a holistic view of market sentiment.

Make Informed Decisions

Finally, use your findings from the sentiment analysis to inform your trading or investment strategies:

It may be a good time to invest if positive sentiment is backed by solid fundamentals (e.g., technological advancements or partnerships).

Conversely, if negative sentiment is rising due to regulatory concerns or community dissatisfaction without any counteracting positive news, consider reducing exposure or taking profits.

Step 4: On-Chain Analysis

Unlocking The Secrets of Transaction Volume

Transaction volume indicates how frequently a crypto is being used. Higher transaction volumes often reflect greater adoption and utility within the network.

Pro Tip

Use platforms like Glassnode or CoinMetrics to track transaction volume over time.

Active Addresses Are Where the Action Is

An increasing number of active addresses signals growing interest in crypto. Active addresses represent the unique addresses involved in sending or receiving transactions.

Pro Tip

Compare the trend of active addresses to price movements for deeper insights.

Hash Rate: The Security Metric You Can’t Ignore

The hash rate for Proof of Work (PoW) digital assets like Bitcoin reflects the computational potential used to mine new blocks. A higher hash rate indicates a more secure and decentralized network.

Pro Tip

A rising hash rate typically correlates with increased confidence in the crypto's future.

Unlocking Financial Freedom Through Expert Options and Crypto Trading Guidance

Unlock financial freedom through expert options and crypto trading guidance with Digital Dollars Trading. We provide a premier community, mentorship program, and proven strategies to help you master profitable trading. We've helped our students to make upwards of $30,000+ in a single day through our 1-1 mentorship, Exclusive Workshops & VIP Events, Daily trading signals, live calls, and expert tips from Trey. Escape the rat race with Trey and the rest of the Digital Dollars Trading community today. Try it out today!

Risk Management in Crypto Trading

Risk management refers to traders' strategies and techniques to minimize potential trade losses. A solid risk management plan is crucial for long-term success in crypto trading, where price volatility is exceptionally high.

Why It’s Important

Minimizing Losses

The crypto market is unpredictable, and even experienced traders can face sudden market downturns. Effective risk management can help minimize losses when trades don’t go as planned.

Preserving Capital

By managing your risk on each trade, you can ensure you have enough capital to continue trading even if a few trades result in losses.

Steps to Implement Risk Management

Step 1: Set Stop-Loss Orders

A stop-loss order is an automatic instruction to sell crypto when its price reaches a certain level. This limits the amount of loss you incur on a trade.

Key Tips

Determine Your Risk Tolerance: Decide how much you will lose on a trade before entering it. Set your stop-loss order slightly below your entry price to limit potential losses.

Trailing Stop-Loss: A trailing stop-loss moves with the market price, allowing you to lock in profits while protecting against downside risks.

Pro Tip

Set stop-loss levels based on technical indicators, such as support levels or recent lows, to ensure they're placed in strategic positions.

Step 2: Diversify Your Portfolio

Diversification involves spreading your investments across multiple digital assets or even different asset classes (like stocks or commodities) to reduce risk.

Why It Works

If one crypto underperforms, gains from other assets can offset the losses, reducing overall portfolio risk.

Pro Tip

Avoid putting all your capital into one coin or token. Instead, allocate smaller portions to various digital assets that span different sectors (e.g., DeFi, NFTs, or utility tokens).

Step 3: Use Position Sizing

Position sizing refers to controlling the capital you allocate to any trade. This helps prevent losing a significant portion of your funds in one bad trade.

How to Do It

The 1-2% Rule: Only risk 1-2% of your total portfolio on any trade. For example, if you have $10,000 in your portfolio, you should only risk $100-$200 on a single trade.

Pro Tip

Position sizing is critical in highly volatile markets like crypto. Keeping your trade size small relative to your portfolio reduces the risk of catastrophic losses.

Risk-to-Reward Ratio

How It Works

The risk-to-reward ratio helps traders assess whether a trade is worth taking. This ratio compares a trade's potential profit to your risk. A standard ratio of 1:3 means you aim to make three times the amount you risk.

Pro Tip

Before entering any trade, ensure the potential reward justifies the risk. Trades with a favorable risk-to-reward ratio will likely be profitable in the long run.

Unlocking Financial Freedom Through Expert Options and Crypto Trading Guidance

Unlock financial freedom through expert options and crypto trading guidance with Digital Dollars Trading. We provide a premier community, mentorship program, and proven strategies to help you master profitable trading. We've helped our students to make upwards of $30,000+ in a single day through our 1-1 mentorship, Exclusive Workshops & VIP Events, Daily trading signals, live calls, and expert tips from Trey. Escape the rat race with Trey and the rest of the Digital Dollars Trading community today. Try it out today!

Related Reading

• Short Term Crypto Trading

• Crypto Technical Analysis

• Crypto Financial Advisor

• Top Crypto Influencers

• Best Crypto Trading Bot For Beginners

• Cryptocurrency Risks

• Bitcoin Trading Strategies

• Cryptocurrency Analysis

• Crypto Portfolio Allocation

• Day Trading Cryptocurrency

• Crypto Analysis Tools

• Best Crypto Discord

How Digital Dollar Trading Can Help You Analyze Crypto Effectively

Master Jedi of Crypto Signals

This section will explore how Digital Dollars Trading can help individuals advance their crypto analysis skills. By leveraging the mentorship, community, and resources provided by Digital Dollars Trading, traders can gain the insights and strategies necessary to make profitable trades.

Expert Mentorship and Proven Strategies

How It Works

At Digital Dollars Trading, members can access expert mentorship from seasoned traders like Trey Munson. Munson has helped students generate significant returns—upwards of $30,000+ in a single day. The mentorship focuses on actionable strategies for analyzing and trading digital assets effectively.

Why It’s Valuable

One-on-One Guidance: Receive personalized mentorship that addresses your unique trading style, risk tolerance, and goals. This mentorship ensures that your crypto analysis methods are tailored for optimal results.

Proven Strategies: Learn strategies tested and proven in real-market conditions. This will save you time and help you avoid common pitfalls in crypto analysis.

Example Use Case: A beginner trader who joins Digital Dollars Trading will gain hands-on training in technical and fundamental analysis, which will help them spot trends, identify buy/sell signals, and manage risk efficiently.

Access to Exclusive Trading Signals and Real-Time Insights

How It Works

Members of Digital Dollars Trading receive daily trading signals, live calls, and real-time market insights that can guide crypto trades. These signals help traders make more informed decisions based on market trends and analysis.

Why It’s Valuable

Save Time on Research: Members receive curated trading signals that point them toward profitable opportunities instead of spending hours analyzing crypto charts.

Real-Time Updates: Markets move quickly, and Digital Dollars Trading provides live insights and calls, ensuring members never miss out on critical opportunities.

Example Use Case: A trader can receive a signal to buy a particular crypto at a specific price point based on technical analysis provided by Trey and the team. This allows for faster decision-making and capitalizes on profitable moments.

Exclusive Workshops and VIP Events for In-Depth Analysis

How It Works

Digital Dollars Trading hosts exclusive workshops and VIP events where members can learn advanced crypto analysis techniques. These events dive deep into the strategies used by professional traders to understand market movements, sentiment, and on-chain analysis.

Why It’s Valuable

Advanced Education: These workshops offer a more in-depth understanding of crypto analysis, covering on-chain metrics, blockchain technology evaluation, and advanced chart patterns.

Networking Opportunities: VIP events provide opportunities to network with other traders and share insights and tips on the latest market developments.

Example Use Case: Attending a VIP workshop on blockchain data analysis could teach you how to track whale movements or large transactions on the network, providing clues about market direction before the general public catches on.

Comprehensive Support System Through a Trading Community

How It Works

Digital Dollars Trading provides a premier community of like-minded traders who support and share insights. The community offers ongoing discussions, tips, and real-time feedback, helping traders refine their crypto analysis skills.

Why It’s Valuable

Collaborative Learning: Engage with fellow traders and learn from their experiences. The community is valuable for real-time analysis, trading tips, and market sentiment.

Peer Accountability: Having a community of traders means you stay accountable to your trading goals while receiving support and motivation from others in the same journey.

Example Use Case: A trader might notice a sudden market trend and post it in the community for feedback. Fellow traders provide their analysis, either confirming the trend or advising caution, helping everyone make better-informed decisions.

Learn How To Trade Profitably in The Digital Dollars Trading Discord

Digital Dollars Trading helps traders escape the rat race with expert guidance on options and crypto trading. With our premier community and mentorship program, you can master the art of trading to unlock financial freedom. Make no mistake: trading can be a profitable venture. We’ve helped our students to make upwards of $30,000+ in a single day through our exclusive workshops, daily trading signals, live calls, and expert tips from Trey Munson. Try Digital Dollar Trading today and unlock the door to financial freedom.

Related Reading

• How To Day Trade Cryptocurrency

• Crypto Indicator

• Best Crypto Courses

• Technical Analysis Crypto

• How To Analyze Cryptocurrency

• Crypto Risk Management

• Top Crypto Traders

• Crypto Resources

Terms of Service