10 Best Options Trading Tools To Try Right Now

Jun 6, 2024

Trey Munson

Option Trading Strategy

Are you looking to enhance your Options Trading Strategy? Dive into the world of option trading tools with our guide. Uncover valuable insights and tips that can help you overcome your challenges and improve your trading game. Get ready to learn and practice online options trading like never before.

Digital Dollar Standing's Options Trading Platform offers the perfect solution to help you achieve your goals. With this essential tool, you can easily learn and execute options trading online, making the most of your trading strategies.

Table of Contents

What Is Options Trading

Options are versatile financial products. These contracts involve a buyer and seller, where the buyer pays a premium for the rights granted by the contract. Call options allow the holder to buy the asset at a stated price within a specific time frame.

Put options, on the other hand, allow the holder to sell the asset at a stated price within a specific time frame. Each call option has a bullish buyer and a bearish seller, while put options have a bearish buyer and a bullish seller.

Why Options Trading is Engaging

Traders and investors buy and sell options for several reasons. Options speculation allows a trader to hold a leveraged position in an asset at a lower cost than buying shares of the asset. Investors use options to hedge or reduce the risk exposure of their portfolios.

Related Reading

• Options Trading Brokers

• Best Options Trading Course

• Options Trading Discord

• Options Trading Alerts

Where To Best Learn Options Trading?

1. Stockdaddy's Advance Option Trading Course

Stockdaddy's Advanced Option Trading Course is designed for traders who have a basic understanding of options and are looking to take their skills to the next level.

This course delves into advanced option strategies, hedging strategies, option expiry trading strategies, expiry and strike price, moneyness and premium, PCR analysis, Bear Put Spread Strategies, Bear Call Spread Strategy, Iron Condors, and many more.

Led by experienced professionals, Stockdaddy provides comprehensive training materials, live webinars, and personalized mentorship to ensure participants can confidently execute complex trades.

2. Mastering Futures and Options by BSE Varsity

BSE Varsity, the educational arm of the Bombay Stock Exchange, offers the Mastering Futures and Options course. This comprehensive program covers the fundamentals of options trading and enables participants to understand the nuances of derivatives pricing, risk management, and hedging strategies.

Focusing on real-life examples and case studies, BSE Varsity equips traders with the analytical tools and practical knowledge required to make informed decisions in the options market.

3. Stockdaddy: Options Trading Course

Stockdaddy's Options Trading Course caters to beginners new to options trading. This course provides a solid foundation for understanding options, including concepts such as options Greeks and advanced option selling strategies.

OI And option chain, call and put options, option pricing, Option Intraday Setup, and basic strategies. With interactive modules, video tutorials, and quizzes, Stockdaddy ensures participants grasp the fundamentals before venturing into more complex trading strategies.

4. Futures and Options Trading Strategies by NSE India

National Stock Exchange (NSE) India offers a comprehensive course on Futures and Options Trading Strategies. This program provides a holistic understanding of derivatives markets, including futures, options, and their applications in various trading scenarios.

Participants will learn how to analyze market trends, develop trading strategies, and effectively manage risk. NSE's course includes simulation exercises, case studies, and expert-led sessions to enhance the learning experience.

5. Options Theory for Professional Trading by Zerodha Varsity

Zerodha Varsity's Options Theory for Professional Trading is a comprehensive course that caters to both beginners and experienced traders. Covering topics such as option Greeks, volatility, and option pricing models, this course equips participants with the knowledge to make informed trading decisions.

Zerodha Varsity's user-friendly interface and interactive content, including quizzes and assignments, make learning options trading engaging and accessible.

10 Best Options Trading Tools To Try Right Now

1. Digital Dollars Trading

Digital Dollars Trading offers a comprehensive platform for those seeking to master profitable trading. With expert guidance from Trey Munson, the platform provides a premier community, mentorship program, and proven strategies to help traders navigate the options and crypto markets successfully.

2. moomoo

moomoo stands out for its high customizability, professional-grade Level 2 NYSE market data access, and zero-commission trading. This platform enables traders to access real-time bids and asks on the New York Stock Exchange, view options chains clearly, and stay updated with the latest news to execute the best possible trading strategies efficiently.

3. Tasty Trade

Tasty Trade offers commission-free stock and ETF trading with competitive rates for options trading. The platform's pricing structure, particularly the cap on option commissions at $10 per round trip, makes it cost-effective for traders engaging in multi-leg trades.

4. Trade Station

Trade Station's options-specific tools provide a wealth of information and detailed analysis for traders. The platform allows users to test various strategies, evaluate results across multiple expiration dates, and visualize options chains to identify potential winning trades.

Additionally, Trade Station's EasyLanguage scripting language facilitates trade automation.

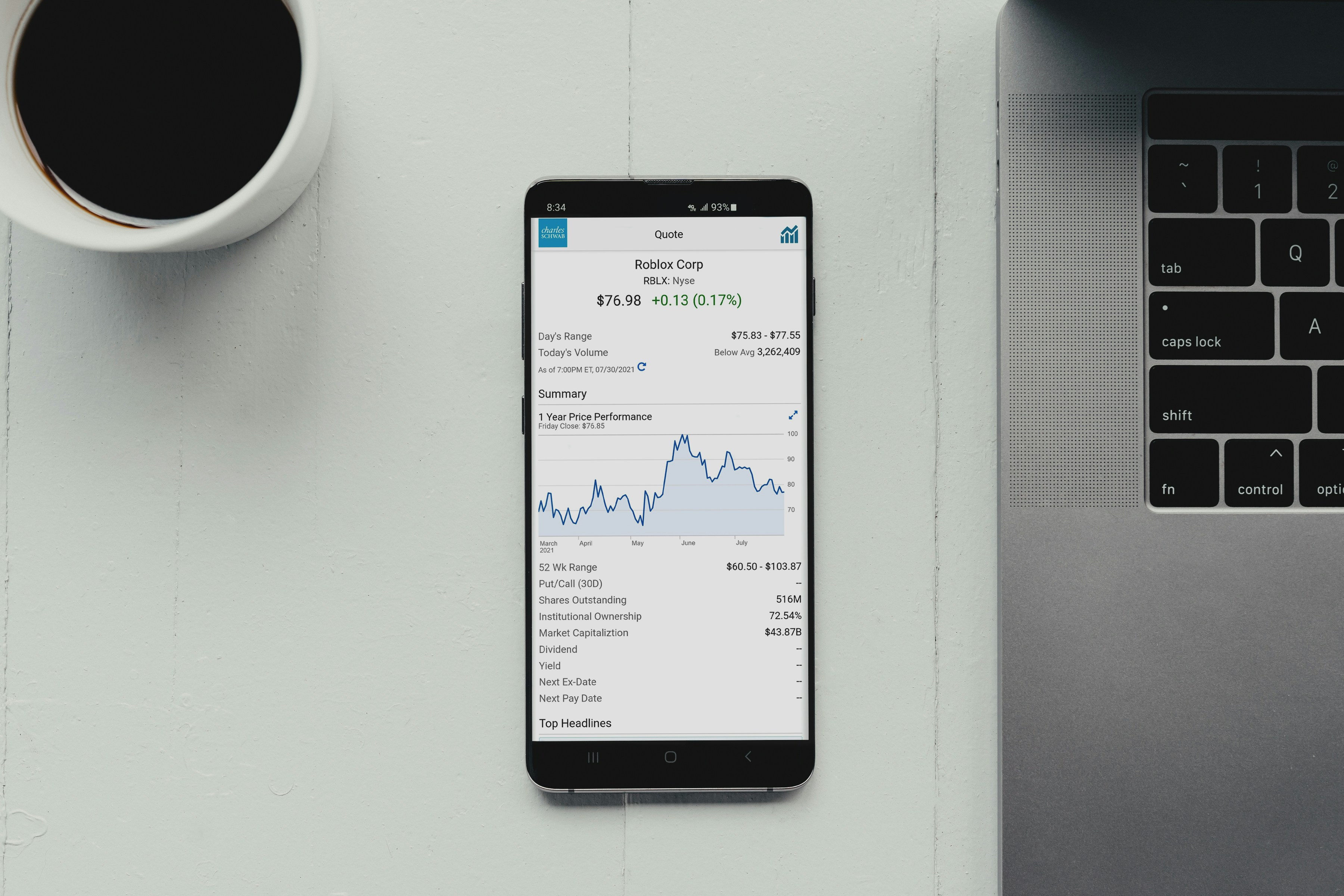

5. Charles Schwab

Charles Schwab, a full-service broker with a discount broker mindset, offers access to multiple markets, account types, and platforms. Schwab integrates thinkorswim into its platform, providing top options analytics and the ability to paper trade before committing real capital. This feature-rich platform allows users to select specific option strategies and contracts easily.

6. TD Ameritrade

TD Ameritrade caters to both beginners and experienced traders with a wide array of research resources and exceptional customer service. The platform's thinkorswim trading platform streamlines the process of finding and executing trades by allowing users to chart, research, analyze, and place orders within the platform.

7. Interactive Brokers

Interactive Brokers caters to both institutional and retail trading customers with advanced features. Users can choose between IBKR Lite and IBKR Pro plans, each offering unique benefits. The platform provides excellent screeners for various asset classes and allows customization for a seamless trading experience.

8. Fidelity

Fidelity's strong features, real-time data feeds, and accessible interface make it an appealing option for options traders. The platform's well-designed mobile apps pool information from third-party providers, such as Moody's and Morningstar, enhancing the trading experience.

9. Robinhood

Robinhood's straightforward design and intuitive interface make it a user-friendly platform for options trading. The platform's commitment to low fees ensures that traders can engage in options trading without the industry-standard per-contract fee.

10. Trading View

Trading View's versatile platform offers a wide array of indicators, alerts, and analysis tools for traders. The platform also serves as a social network for sharing insights and ideas. TradingView Pro, the paid version, enables users to access additional features for advanced trading strategies.

Unlock financial freedom through expert options and crypto trading guidance with us at Digital Dollars Trading. We provide a premier community, mentorship program, and proven strategies to help you master profitable trading.

We've helped our students to make upwards of $30,000+ in a single day through our 1-1 mentorship, Exclusive Workshops & VIP Events, Daily trading signals, live calls, and expert tips from Trey. Escape the rat race with Trey and the rest of the Digital Dollars Trading community today. Try it out today!

Related Reading

• Learn Options Trading

• How Much Can You Make Trading Options

• Can You Make a Living Trading Options

• Can You Make Money Trading Options

• How to Read Options

• Most Successful Options Traders

• Tasty Works

• AI Options Trading

• Options Trading Course

• Top One Trader

• Famous Stock Traders

• What Percentage of Option Traders Make Money

• Famous Traders

Which Analysis Is Best For Options Trading?

Technical analysis is the best approach for options trading as it focuses on analyzing historical market data to identify trends and make informed decisions based on price movements. By focusing on price, technical analysis is particularly useful for options trading, as the strike price is a crucial component of each trade.

This type of analysis primarily studies historical market data and visualizes supply-and-demand shifts through chart patterns. Technical analysis also factors in the emotional aspects of the marketplace, recognizes the capital risk of trading and investing decisions, and does not rely on predicting the future.

Ultimately, technical analysis can help options traders make more informed decisions based on historical trends and price data.

Supply-and-Demand Dynamic in Options Trading

Options trading relies on the principle of supply and demand to determine the value of contracts. Technical analysis helps visualize these supply-and-demand shifts through chart patterns.

By recognizing these patterns, options traders can better predict future price movements and make more informed decisions on which strike prices to choose. Understanding the supply-and-demand dynamic of options trading is crucial to making successful trades and maximizing profits.

Emotional Aspects of Options Trading

The emotional aspects of the marketplace can significantly influence trading decisions. Fear and greed are common emotions that drive market movements. Technical analysis helps quantify the emotional aspects of trading by providing historical data on price movements and market shifts.

By understanding how emotions can impact trading decisions, options traders can make more rational and informed choices when selecting strike prices and executing trades.

Capital Risk in Options Trading

Options trading involves a certain level of risk, and understanding the capital risk of each trade is essential for success. Technical analysis helps quantify the risk associated with trading and investing decisions by analyzing historical market data and price movements.

By recognizing patterns and trends in the market, options traders can better assess the risk of each trade and make more informed decisions on strike prices and trade execution.

Predicting the Future in Options Trading

One of the key principles of technical analysis is that it does not try to predict the future. Instead, technical analysis focuses on analyzing historical market data to identify trends and patterns that can help options traders make more informed decisions.

By focusing on price movements and historical data, options traders can make more educated choices on strike prices and trades without relying on predictions about future market movements.

Learn How To Trade Profitably in The Digital Dollars Trading Discord

Introducing Digital Dollars Trading, a platform that provides a premier community, mentorship program, and proven strategies to help you master profitable trading. Digital Dollars Trading aims to unlock financial freedom for its clients by offering expert options and cryptocurrency trading guidance.

Discover the Power of 1-1 Mentorship

One of Digital Dollars Trading's key features is the 1-on-1 mentorship program. By providing personalized guidance and support, traders can take their trading skills to the next level. With the help of knowledgeable mentors, clients can make better trading decisions and maximize their profits.

Exclusive Workshops & VIP Events

Digital Dollars Trading also offers exclusive workshops and VIP events to its clients. These events provide an opportunity to deepen your knowledge of trading strategies and network with other traders. By participating in these events, you can stay ahead of the curve and enhance your trading skills.

Daily Trading Signals and Live Calls

Staying informed about market trends is crucial for successful trading. Digital Dollars Trading provides daily trading signals and live calls to help traders make informed decisions. By leveraging these resources, traders can identify profitable trading opportunities and execute timely trades.

Expert Tips from Trey Munson

Trey Munson, a seasoned trader, shares his expert tips with the Digital Dollars Trading community. By following his advice, traders can navigate the market with confidence and increase their chances of success. Trey's insights can help traders avoid common pitfalls and optimize their trading strategies.

Join the Digital Dollars Trading Community Today

If you're ready to take your trading skills to the next level, consider joining the Digital Dollars Trading community. By leveraging the platform's resources, mentorship program, and expert tips, you can unlock financial freedom and achieve your trading goals.

Start your journey to success with Digital Dollars Trading today!.

Related Reading

• Options Trading Resources

• Options Trading Success Stories

• Options Trading Group

• Options Trading Mentor

• Is Option Buying Profitable

• Option Alpha

• Options Alpha

• Options Playbook

• Bullish Bears

• Tasty Works

• Trading Analyst

• Option AI

Terms of Service